Kam Financial & Realty, Inc. Can Be Fun For Everyone

Kam Financial & Realty, Inc. Can Be Fun For Everyone

Blog Article

The Buzz on Kam Financial & Realty, Inc.

Table of ContentsRumored Buzz on Kam Financial & Realty, Inc.What Does Kam Financial & Realty, Inc. Mean?Little Known Questions About Kam Financial & Realty, Inc..The 8-Minute Rule for Kam Financial & Realty, Inc.An Unbiased View of Kam Financial & Realty, Inc.More About Kam Financial & Realty, Inc.

We may obtain a fee if you click a lender or submit a kind on our web site. This charge in no means impacts the information or suggestions we offer. We maintain editorial freedom to make certain that the referrals and understandings we give are unbiased and honest. The lenders whose rates and various other terms appear on this chart are ICBs promoting companions they supply their rate info to our data partner RateUpdatecom Unless adjusted by the customer advertisers are sorted by APR most affordable to highest For any kind of advertising partners that do not supply their price they are listed in ad display systems at the bottom of the graph Advertising and marketing partners may not pay to boost the frequency concern or importance of their display screen The rates of interest interest rate and other terms advertised right here are price quotes offered by those promoting partners based on the information you went into above and do not bind any loan provider Regular monthly settlement quantities stated do not include amounts for tax obligations and insurance coverage premiums The real payment commitment will certainly be greater if tax obligations and insurance coverage are consisted of Although our data partner RateUpdatecom collects the info from the economic establishments themselves the precision of the data can not be assured Prices may change without notification and can change intraday Several of the info consisted of in the price tables consisting of however not limited to unique advertising and marketing notes is provided straight by the lending institutions Please validate the rates and deals before requesting a funding with the financial institution themselves No price is binding up until secured by a loan provider.

Kam Financial & Realty, Inc. Fundamentals Explained

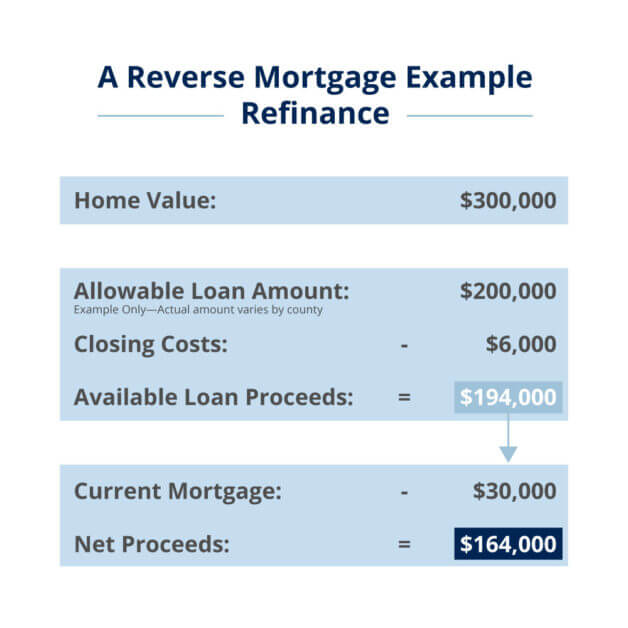

The quantity of equity you can access with a reverse mortgage is established by the age of the youngest consumer, current interest rates, and the worth of the home in concern. Please note that you may need to reserve extra funds from the lending continues to pay for taxes and insurance policy.

Passion rates may differ and the mentioned rate may transform or not be offered at the time of funding commitment. * The funds available to the customer may be limited for the very first twelve month after lending closing, due to HECM reverse mortgage requirements (https://padlet.com/luperector/my-radiant-padlet-un9q4j8kgjt842ov). Furthermore, the customer may need to allot additional funds from the finance continues to pay for tax obligations and insurance

A home loan is basically a monetary arrangement that enables a consumer to acquire a residential or commercial property by obtaining funds from a loan provider, such as a bank or banks. In return, the lending institution positions a property lien on the residential or commercial property as safety and security for the funding. The home loan deal typically involves 2 major records: a promissory note and an act of trust.

The 6-Minute Rule for Kam Financial & Realty, Inc.

A lien is a legal claim or passion that a lending institution has on a customer's residential property as safety for a debt. In the context of a home mortgage, the lien produced by the action of count on allows the lender to take belongings of the building and sell it if the customer defaults on the finance.

Listed below, we will certainly take a look at several of the common sorts of home mortgages. These home loans feature a fixed rates of interest and monthly settlement amount, providing stability and predictability for the customer. For instance, John determines to get a residence that sets you back $300,000. He secures a 30-year fixed-rate home mortgage with a 4% rate of interest.

Top Guidelines Of Kam Financial & Realty, Inc.

This suggests that for the whole 30 years, John will make the same month-to-month repayment, which offers him predictability and stability in his economic planning. These mortgages start with a fixed rate of interest and payment quantity for an initial period, after which the rate of interest price and settlements might be periodically changed based on market conditions.

Get This Report on Kam Financial & Realty, Inc.

These mortgages have a fixed rate of interest and repayment quantity for the financing's period yet require the consumer to pay off the funding equilibrium after a given duration, as figured out by the lender. mortgage lenders in california. As an example, Tom is interested in buying a $200,000 home. https://www.provenexpert.com/lupe-rector/?mode=preview. He chooses a 7-year balloon home mortgage with a 3.75% go to website set rates of interest

For the entire 7-year term, Tom's month-to-month payments will certainly be based on this fixed rates of interest. Nevertheless, after 7 years, the staying financing balance will certainly become due. Then, Tom must either pay off the outstanding balance in a round figure, refinance the loan, or sell the building to cover the balloon settlement.

Falsely asserting self-employment or a raised setting within a business to misrepresent earnings for home mortgage functions.

Indicators on Kam Financial & Realty, Inc. You Should Know

Report this page